Marriage Rebate Explained

Have you or your partner earned less than your Personal Tax Allowance or been unemployed in the last 4 years?

Well, if that applies to you then you have a chance to transfer some of your unused Tax Allowance to your partner.

HMRC allows 10% of your unused allowance to be transferred, but that is only useful if your partner’s salary is between the standard rate of tax i.e., for 2019/20 between £12,500 and £ 50,000.

A simple way to find out if you are entitled to a Marriage Tax Rebate is to make use of our free tax calculator.

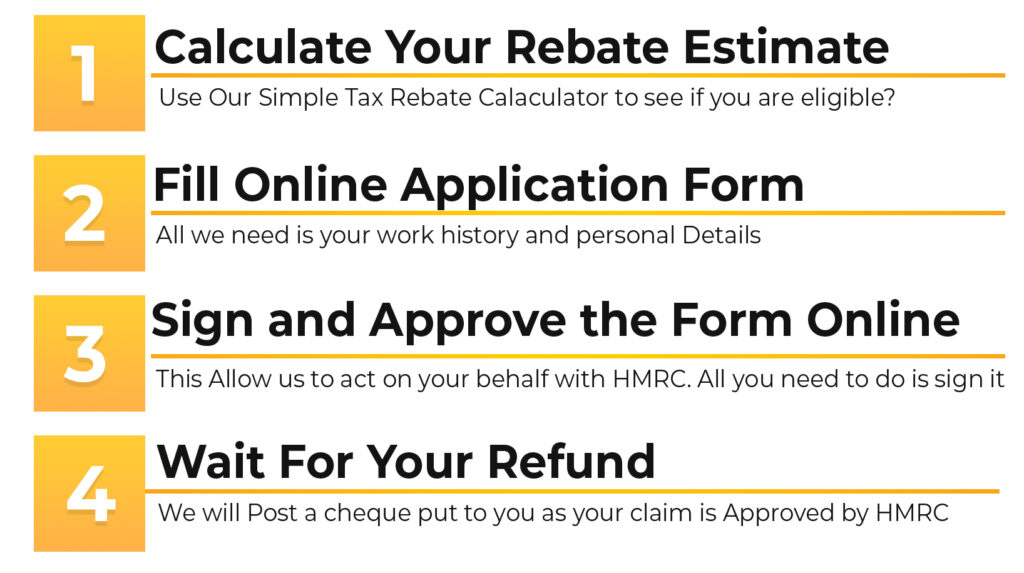

How do I claim a Tax Rebate?

Don’t worry, the tax rebate process does not require historical data / receipts. We have kept it very simple. Use our online calculator for eligibility, then just complete a few basic questions on our online form and we will do the rest.

As your tax agent, we deal with all inquiries from HMRC and you receive a tax refund cheque in the post.

Tax Rebate services has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates, PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more..

How much refund can I get?

The amount of tax you may recover depends on how many years you have had valid earnings up to a maximum of last 4 years. Of course your rebate is only valid from your marriage date (civil partnership also).

On average if your partner can transfer the full 10% of their Tax Allowance then on average that is about £ 240 per valid year.

Check out our online calculator for eligibility and Tax Relief amount.

Our Other Services

You may also be entitled to a refund if you use your own tools (Tool Allowances Tax Rebates), PPI, if you drive your own vehicle in the course employment (Mileage Allowance Tax Refund), Magazine subscription allowances tax refund, if you are a member of a union (Union Fees Tax Refund).

Should you have any queries, as to whether you are entitled to any of the above tax claims, you may use our calculator, or submit a query to our email, where a member of our team will be more than happy to advise you.

How do you submit a claim for Tax Rebate?

This is where the team at Tax-Rebate helps you. We have worked in this sector for many years and reclaimed tax for countless employees just like you.

We have made the process extremely straightforward. You may make use of our online tax calculator to find out how much of a refund you are entitled to.

Once you have done this and are keen to use our services, you may go on to complete the form on our website.

The form asks you for some personal details and the name of your employer, the sector you work in and your job role. You then sign the form and we do the rest. It really is that simple.

Our experienced team will then review your details and liaise with HMRC directly. Within a few weeks, you will be receiving a cheque of the tax rebate in the post, without any further steps required from yourself.